The year 2025 has brought one of the most dramatic shifts the storage industry has seen in over a decade. Prices for both NAND flash and DRAM have surged at a pace that has shocked consumers, resellers and manufacturers alike. Multiple industry reports confirm the same trend: NAND flash prices have doubled within just three months, and analysts warn that the industry faces ongoing shortages with no relief in sight.

What’s causing this sudden spike? How long will it last? And, importantly, what should you do if you rely on SSDs, PCs, or storage-based devices?

This guide breaks it all down in a simple, digestible way.

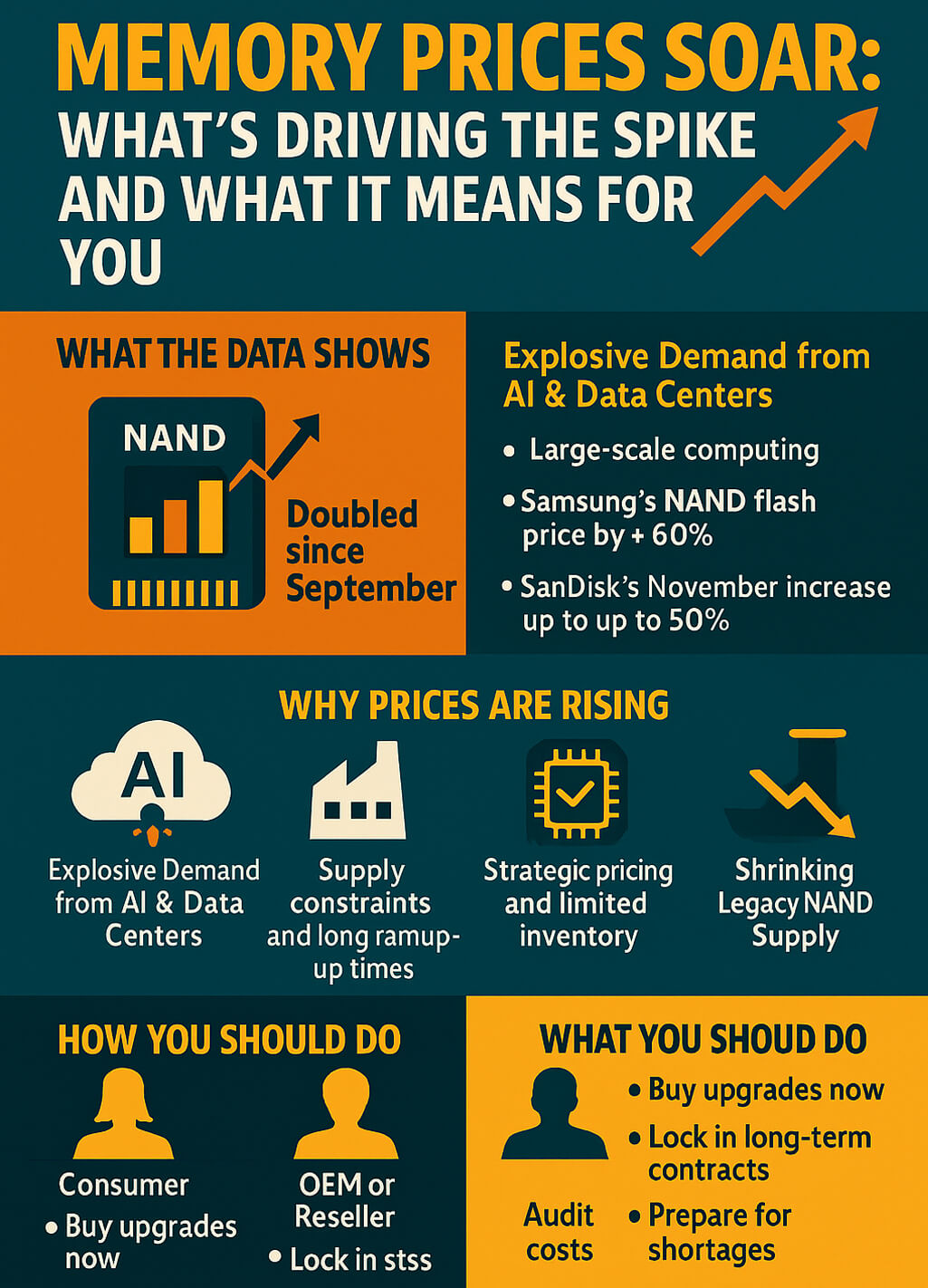

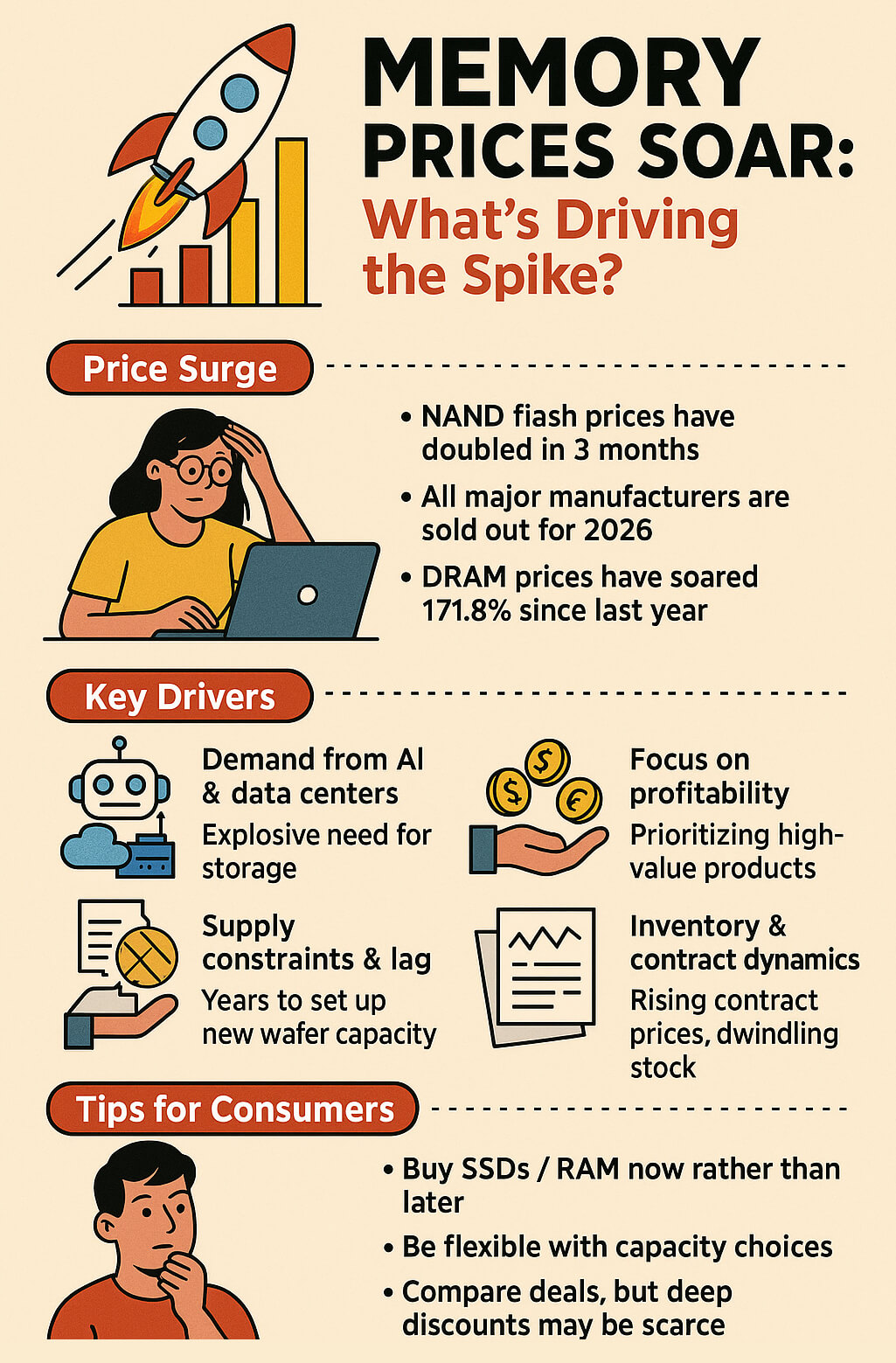

What the Data Shows

Recent reports highlight several critical trends that point to a severe supply-demand imbalance:

The CEO of Phison revealed that NAND flash memory prices have doubled in only three months, signalling a sharp and unexpected rise.

Major manufacturers are fully sold out for 2026, meaning new purchases now won’t be fulfilled for well over a year.

Samsung has raised NAND flash contract pricing by 60% since September, while DRAM has seen an astonishing 171.8% increase year-on-year.

SanDisk announced a 50% contract price hike for November, marking its third price increase this year and pushing the market into a new tight cycle.

The primary triggers? AI demand, large-scale data-centre expansion, shift to high-end 3D NAND, and reduced legacy NAND production.

Together, these factors have created an environment where memory manufacturers hold more pricing power than they have in years.

Why Prices Are Rising So Quickly

Several major forces are colliding at the same time, producing what many analysts consider a “perfect storm” for rising memory costs.

1. Explosive Demand from AI & Data Centres

The rise of generative AI, large-scale model training, and AI-powered cloud services has driven extraordinary demand for high-capacity SSDs, HBM, and DDR5 DRAM.

Every AI model—from consumer chatbots to industrial LLM platforms—requires enormous amounts of memory and storage. This demand is growing so fast that manufacturers cannot scale production quickly enough to keep up.

2. Supply Constraints and Long Ramp-Up Times

Memory manufacturing capacity isn’t something that can be expanded overnight. Building new fabs takes years, requires billions in investment, and often involves node transitions that slow production temporarily.

Manufacturers have also been shifting resources away from older, low-margin products. This means:

Less supply of older NAND

Fewer low-capacity chips in circulation

More focus on premium products (3D NAND, HBM)

This shift reduces the availability of mainstream consumer memory and drives prices upward.

3. Strategic Pricing and Limited Inventory

Manufacturers know demand is strong — and they’re pricing accordingly.

With contracts locked out to 2026, suppliers feel no pressure to lower prices.

SanDisk’s 50% price increase is a sign of the new normal: memory makers are using this opportunity to boost margins after years of depressed prices.

4. Shrinking Legacy NAND Supply

Many companies have already phased out older production nodes, which historically supplied:

Budget SSDs

USB drives

Lower-capacity embedded storage

With older NAND lines shutting down, manufacturers concentrate on fewer but more profitable models — further restricting supply for mainstream use.

What This Means for Different Buyers

For Consumers

If you’re planning an upgrade or a new device purchase:

Expect higher prices for SSDs, NVMe drives, and RAM.

Bargain storage deals may disappear for a while.

Some devices may launch with lower storage capacities to control costs.

The advice from industry insiders is clear: buy sooner rather than later if you need an upgrade.

A 2TB SSD that cost £99 earlier this year may soon be £149–£179 — or out of stock entirely.

For OEMs and System Builders

Manufacturers face several challenges:

Margin pressure due to expensive components

Supply chain delays on upcoming product launches

Potential need to reconfigure devices with lower-capacity storage

Increased importance of strategic inventory planning

Contract trends suggest that many hardware companies will have to raise retail prices in Q1/Q2 2026.

For Memory Manufacturers

This is one of the most profitable cycles in recent years:

Higher demand

Limited competition

Long backlogs

Strong pricing power

However, chip makers must balance this with the risk of over-investing into new fabs that may not be needed once the cycle normalises.

For Other Industries (Automotive, IoT, Industrial)

Many sectors do not normally compete with AI companies for memory components — but now they must.

Expect:

Higher costs for embedded components

Availability issues for industrial-grade NAND

Longer lead times for production hardware

Potential redesigns to accommodate cheaper or smaller modules

How Long Will These Price Increases Last?

Industry experts predict that this cycle may last well into 2026 — and possibly longer.

Why?

AI demand is not slowing down.

Data centres are expanding globally at record pace.

Fab expansion takes 3–5 years.

Manufacturers are prioritising higher-margin products.

Some analysts even warn that NAND shortages could persist for the rest of the decade, though this depends heavily on AI adoption curves.

What You Should Do Now

If You’re a Consumer

Buy storage upgrades now if you need them.

If your laptop or PC is aging, consider upgrading before prices climb further.

If possible, choose mid-range capacities (1TB SSDs often have better value than 2TB right now).

If You’re an OEM or Reseller

Lock in long-term supply contracts where possible.

Consider stockpiling critical components.

Review your product lines for capacity adjustments.

Communicate early with customers about potential price changes.

If You’re in a Sector That Relies on Embedded Memory

Audit BOM costs immediately.

Prepare contingency plans for component shortages.

Explore alternative suppliers or multi-sourcing to minimise risk.

Conclusion

The surge in NAND flash and DRAM pricing marks a major turning point in the storage industry. What was once a stable, predictable commodity market has become a high-volatility, high-demand environment driven by explosive growth in AI and cloud computing.

For consumers, that means higher prices and fewer bargains.

For manufacturers, it means tighter planning and rising costs.

For the industry as a whole, it signals a new era where memory is no longer cheap or abundant.

If you rely on storage — whether for personal upgrades, product development, or large-scale deployments — now is the time to plan ahead and adapt.